Get Ready for a Congressional Budget Blow Out

COMMENTARY

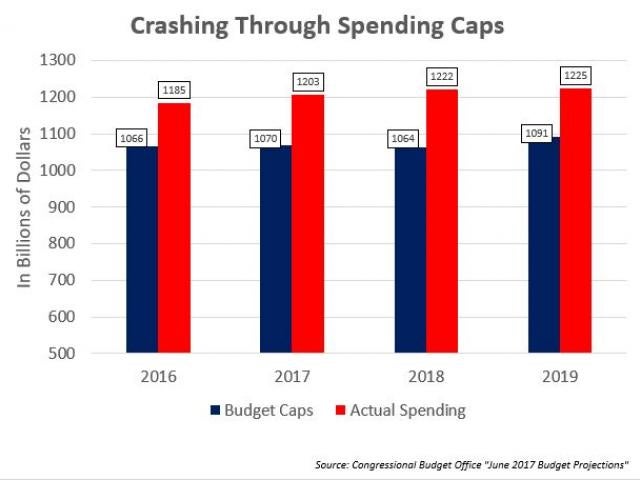

No one is paying much attention, but Congress is preparing a two-year budget that blows past bipartisan spending caps to the tune of $216 billion through 2019.

That may be a best-case scenario. The budget watchers at Freedom Works estimate that when hurricane disaster relief, funding for the border wall, added ObamaCare money for the bankrupt insurance markets, and other last-minute spending "emergencies," are thrown in the mix, the two-year spending blitz could exceed $300 billion.

Donald Trump had better get his veto pen handy.

All of this is happening because Republicans have fallen into the Democrats' fiscal trap. In order to secure more money for national defense, Democrats are demanding an equal amount of extra funding for domestic social welfare programs. So to get an additional $108 billion for the Pentagon, the Republicans may agree to another $108 billion-plus in ransom money for domestic agencies.

But when all the emergency funding is included, the ratio could be closer to $2 of additional domestic spending for every dollar of increased military funding. What a deal.

If this deal gets cut, any pretense of fiscal discipline and debt control. "Almost no one here on either side of the aisle wants to control spending," Sen. Rand Paul, R- KY tells me. "It's sad, but it's the new reality."

This is happening when the $4 trillion federal budget is expected to exceed $5 trillion within eight years and the $20 trillion debt is already headed to $30 trillion over the next decade. That's without this new spending spree.

This would also be a nail in the coffin of the Budget and Control Act, which instituted spending caps and sequester cuts if those caps are exceeded. The BCA caps have worked remarkably well as the very kind of spending blow out that we are now seeing from Congress.

When the BCA was first installed in 2011 during Obama's first term (and after Republican's seized control of Congress), federal spending fell for three years in a row –from $3.6 trillion in 2011 to $3.51 trillion in 2014. This was the first time that happened since the 1950s. The caps have shaved more than $1 trillion from the spending that was supposed to happen without them.

Given that the caps are a success, why scrap them now?

The answer is that the caps have worked too well. The pro-spending lobby in both parties has come to despise the fiscal handcuffs of budget caps and the threat of across-the-board sequester cuts.

This fiscal retreat has exposed fiscal hypocrisy on both sides of the aisle. Republicans pronounce to be the party of fiscal responsibility and limited government, but they are all too happy to be removed from the BCA cage. Meanwhile, Democrats, who unanimously moaned that the Trump tax cuts would blow a hole in the deficit (ignoring the impact on the economy), are willing accomplices in this fiscal jailbreak that will cost the Treasury a trillion dollars more in the long term.

But it won't be Democratic leaders Chuck Schumer and Nancy Pelosi who get blamed for the financial mess left behind. Voters will surely wonder why Republicans who are in charge, let this surge in spending and debt happen on their watch.

A $300 billion spending spree is no way to drain the swamp. But it is a good way for the GOP to find themselves back in the minority after the 2018 elections. Trump may want to use his veto pen to save Republicans from themselves.

Stephen Moore is a senior fellow at the Heritage Foundation and an advisor to Freedom Works.